Toward Fairer and More Sincere Corporate Activities

We aim to earn the trust of society by building an organizational structure and a highly transparent management system that quickly respond to changes in the business environment, as well as by practicing fair and sincere corporate activities.

As competition between companies becomes fiercer, we realize that we must be capable of making quicker management decisions and aim to increase corporate value, while at the same time maintaining compliance (legal compliance) in order to continue to grow. Toward that end, we have established a corporate governance system to ensure that this is done at an organizational level.

The main objectives of this system are:

(1) To ensure continuous and thorough compliance with an awareness of corporate social responsibility

(2) To maintain highly transparent management through fair and prompt disclosure of information to our shareholders, employees, and other stakeholders

(3) Toensure accountability for the processes and results of management decisions

(4) To pursue management efficiency based on rational management decisions. Based on this perspective, we have established a management organization that is both fair and highly transparent, and conduct in-depth employee training to spread awareness of the importance of corporate ethics.

We have adopted a flat management organization capable of adapting quickly and accurately to changes in the business environment while maintaining a small HQ organization. We aim to earn the trust of shareholders and investors, maintaining healthy management, fairness and transparency, by working as effectively as possible to perform the functions of monitoring management and operations through the auditing capacity of corporate auditors, the restraints imposed by a division of duties, and timely disclosures. Also, to strengthen our management oversight, we welcome the presence of independent outside directors.

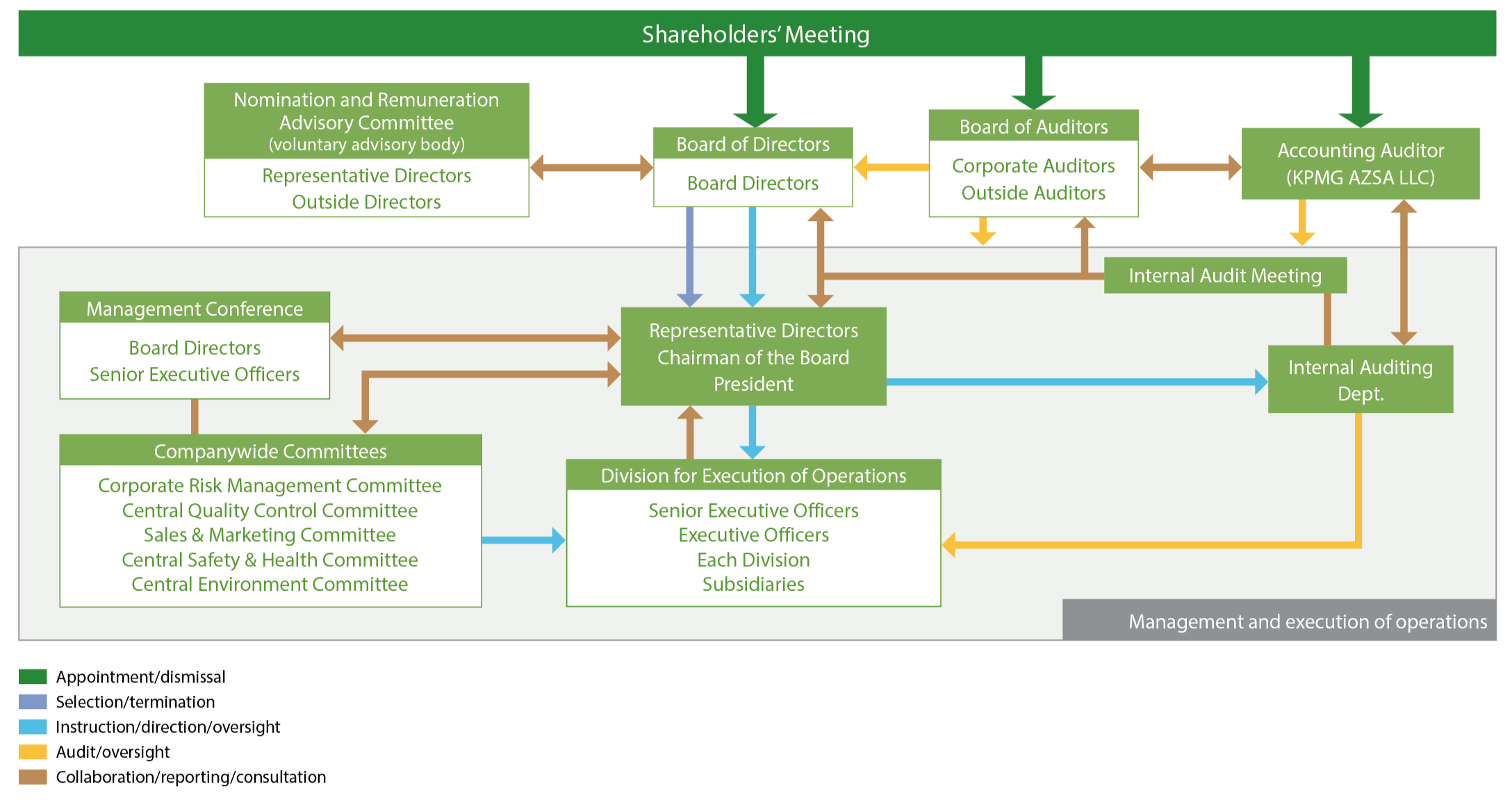

The company uses a system of corporate auditors and a Board of Auditors, who work together with the Board of Directors to supervise and audit how board directors are executing their duties. We have established a corporate governance system better suited to our unique systems of operation and business structure based on the independent management systems of each division and group company, and continue to enhance this system. The following figure provides an overview of our corporate governance system.

Overview and activities of the Board of Directors and executive system

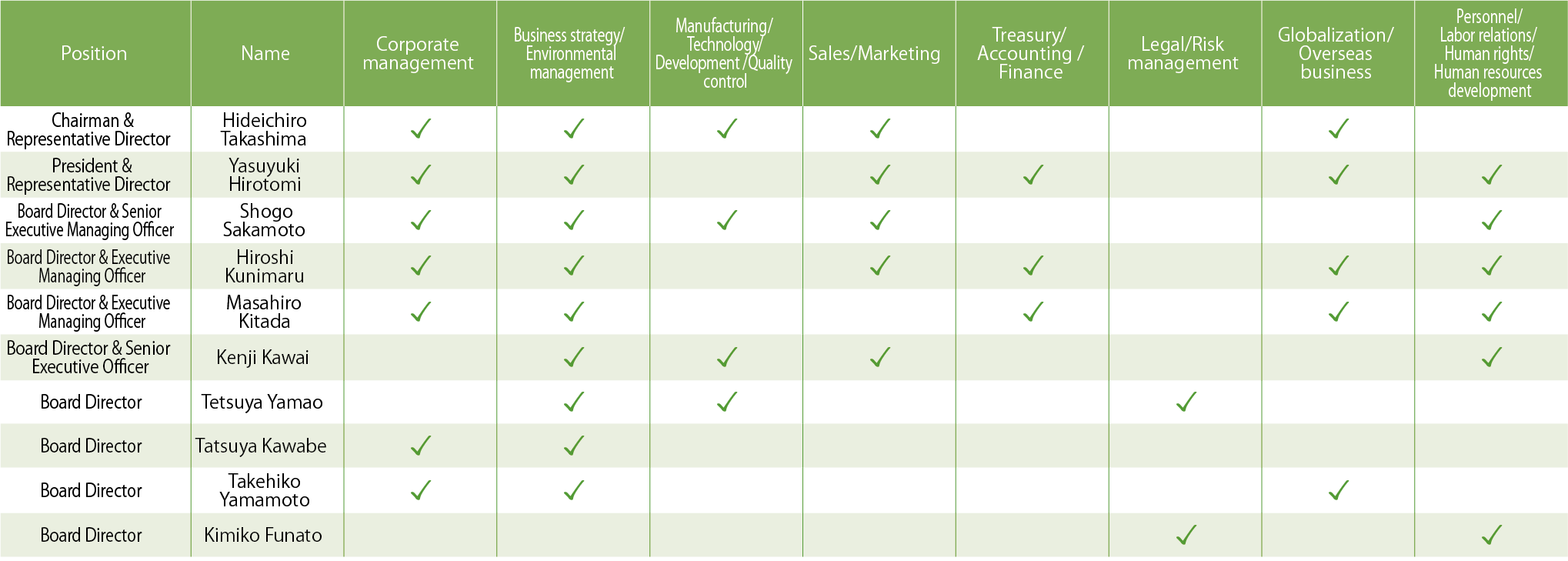

The Board of Directors is responsible for making management decisions, and consists of a total of 11 individuals (two representative directors and nine board directors). Four of these individuals are outside directors, who are designated as independent executives as defined by the Tokyo Stock Exchange.

The Board of Directors determines business administration in accordance with the Companies Act, and has the authority to supervise how board directors are performing their duties. As stipulated in our articles of incorporation, board directors are selected by a majority decision of shareholders participating in the shareholders’ meeting with at least one-third of shareholders with voting rights present, with selection not determined through cumulative voting. Our articles of incorporation also state that there must be no more than 15 board directors.

Regarding the activities of the Board of Directors, 17 meetings were held in FY2023. The attendance rate of directors (including outside directors) and corporate auditors (including outside corporate auditors) was 100%. In principle, the Board of Directors meets once a month, and in addition to individual resolutions, it makes reports and deliberations on consolidated monthly financial results (including the results of group companies), progress of annual and medium-term management plans, operation status of internal control systems, response to corporate governance issues, evaluation and response to major group risks, and evaluation of the effectiveness of the Board of Directors and the status of policy investments.

The Board engages in vigorous discussions and exchanges of opinions.

In FY2023, we focused our deliberations on the following matters:

● Consideration of capital investment and business strategies for qualitative and quantitative improvement of the global tripolar structure

● Business support and restructuring of domestic and overseas related companies

● Human capital management

● Sustainability measures (human capital management, TCFD compliance, etc.)

● Dividend policy

Skills matrix for board directors

The following table shows the areas where expectations for board directors are particularly strong with regard to knowledge, experience, and skills, so that our Board of Directors can effectively fulfill its decision- making and supervisory functions.

Overview and activities of the corporate auditors and the Board of Auditors

Kyoei Steel is a company with a Board of Auditors, which must consist of no more than five corporate auditors according to our articles of incorporation. It currently consists of one full-time corporate auditor, one corporate auditor, two outside auditors, and one reserve corporate auditor.

Although we do not have an auditing staff organization, we have established a system for supporting the work of our one full-time corporate auditor through the Human Resources & General Affairs Department, Accounting & Financing Department, Internal Auditing Department, and Risk Compliance Management Office. The Board of Auditors must include at least one individual with appropriate knowledge of finance and accounting, and at least one independent executive without risk of any conflict of interest with general shareholders.

The Board of Auditors held 14 meetings in FY2023. The attendance rate of corporate auditors (including those from outside the Company) was 100%.

The Board of Auditors meets regularly once a month, and as needed. In FY2023, we focused our deliberations on the following matters:

● Matters to be resolved and deliberated: 27 Items. Selection of Chairman of the Board of Auditors, Selection of a full-time corporate auditor, partial amendment of the regulations of the Board of Auditors, etc.

● Matters to be discussed: 1 item. Discussion of auditor compensation

● Matters to be reported: 69 reports. On the status of execution of duties by auditors; on the results of on-site inspections of offices; on the results of investigations of subsidiaries, etc.

Overview and activities of Nomination and Remuneration Advisory Committee

The Nomination and Remuneration Advisory Committee consists of at least three members (the majority of whom are independent outside directors) selected by resolution of the Board of Directors from among independent outside directors and representative directors. It is an advisory body established to deliberate mainly on the nomination and compensation of representative directors, board directors, corporate auditors, and executive officers, and to provide advice and recommendations to the Board of Directors. It meets as needed.

The Committee held three meetings in FY2023. The attendance rate of the four outside directors and two representative directors was 100%. In addition to these meetings, the Company strives to enhance deliberations such as by providing a forum for discussion between the representative directors and outside directors on important matters in advance.

In FY2023, the following matters were discussed and considered.

● Consideration of candidates for directors and auditors, and composition of the Board of Directors (diversity, skills)

● Consideration of candidates for new executive officers

● Consideration and development plan for future top management candidates

● Status of talent pool and development of future executive candidates

● Compensation policy and system for directors and others

● Consideration of compensation levels based on benchmarks in view of surveys by external expert organizations

● Method and process for determining compensation for individual directors and others for the next fiscal year

Director Compensation, etc.

➀Directors meeting held on March 16, 2022 on the policy for determining compensation, etc. for each individual director. The resolution of the Board of Directors meeting is based on the deliberations of the Nomination and Remuneration Advisory Committee, a voluntary advisory body to the Board of Directors, regarding the details of the resolution.

The Board of Directors has also confirmed that the method of determining compensation, etc. for individual directors and the details of the determined compensation, etc. are consistent with the said decision-making policy, and that the deliberations of the Nomination and Remuneration Advisory Committee are respected. We believe that this system is in line with the related policy.

② Total amount of compensation, etc. by director classification, total amount of compensation, etc. by type, and number of directors subject to compensation, etc.

|

Director classifications |

Total amount of compensation, etc. (millions of yen) |

Total amount of compensation, etc. by type (millions of yen) Performance-linked compensation Basic compensation Numbers |

Numbers of officers subject to compensation |

||

|

Basic compensation |

Self-acquisition Purpose compensation |

Performance-linked compensation |

|||

|

Directors (excluding outside directors) |

252 |

188 |

7 |

58 |

6 |

|

Auditors (excluding outside auditors) |

32 |

32 |

- |

- |

2 |

|

Outside directors |

36 |

36 |

- |

- |

5 |

Overview of the systems for internal control

In general, the Board of Directors supervises how board directors are performing their duties, while corporate auditors audit how board directors are performing their duties. We have also adopted an executive officer system where decision-making and supervisory functions are kept separate from execution functions. Matters that must be decided at the management level are identified, defined based on internal rules, and authority is then transferred appropriately. This increases the effectiveness of supervisory functions and efficiency of business execution.

We have also established the Compliance Program run by the Risk & Compliance Subcommittee (a subcommittee of the Corporate Risk Management Committee), which encourages employees to autonomously and independently promote risk management and compliance. Meanwhile, the Internal Auditing Department, which is positioned directly beneath the president & representative director in the organization of the Company, regularly audits employees to ensure that their duties are being performed appropriately. The Internal Auditing Department also works with the corporate auditor and accounting auditor to conduct internal control audits of financial reports, in order to ensure the reliability of these reports.

Risk management system

We have established the Corporate Risk Management Committee with the president serving as committee chairperson. In addition to screening Group-wide risks from a management perspective, the committee also identifies and evaluates important risks, determines which departments will handle those risks, provides instructions to these departments, and reviews their progress.

If a risk is identified as requiring a separate response, the committee may establish a subcommittee to respond flexibly and dynamically to any changes in the perceived importance of said risk. There are three subcommittees currently operating: the Risk & Compliance Subcommittee (which handles risks related to compliance and human rights), the Climate Change Subcommittee (which handles risks related to climate change), and the Information Security Subcommittee (which handles risks related to information security).

The Board of Directors receives regular reports from the Corporate Risk Management Committee, and supervises the operation of the risk management system. We have established a response system and response procedures within our crisis management rules in preparation for any emergencies that might occur. We have also established policies to minimize the impact to society while also minimizing corporate loss. If an emergency occurs or could occur, the affected site immediately contacts the Human Resources & General Affairs Department at Head Office, which shares information with company management and other parties. We then establish a response system based on the emergency that has occurred, no matter what the case may be, to accurately and quickly determine the situation, allowing us to respond dynamically and flexibly.

Cross Shareholding

The Group’s basic policy is to reduce the number of cross shareholdings, and we strictly assess these investments by examining the benefits and the capital cost of holding the shares. The amount of listed shares held by the Group for cross shareholdings on the consolidated balance sheets as of March 31, 2021 was 2.4 billion yen.

Shareholding Status

(1) Standard and approach for share investment classes

Looking at shares held for pure investment and shares held for other purposes, the Company classifies some as shares purely

for investment if the investment is made solely to receive gains from share value fluctuations or from dividends. Shares

other than the above are classified as investment shares held for purposes other than pure investment.

(2) Investment shares held for purposes other than pure investment

a. Holding policy, the method for verifying the rationale for holding, and details of verification by the Board of Directors, etc.,

regarding the suitability of holding individual shares

When the Company holds investment shares for purposes other than pure investment, we comprehensively determine the

rationale of holding them over the medium to long term, as well as the investment’s profitability, the maintenance and

strengthening of business relationships with investee companies, the importance of the investment in terms of business

strategies, and other factors. In addition, the Company’s basic policy is to reduce holdings of this type of shares. The

Company determines the suitability of holdings at the Board of Directors meeting, etc., each fiscal year, including by

verifying whether or not holding the shares meets the intended purpose and whether or not the associated benefits and

risks are proportionate to the cost of capital.

b. Number of shares and balance sheet amount

|

Number of shares (stock listings) |

Total balance sheet amount (millions of yen) |

|

| Unlisted shares | 3 | 328 |

|

Shares other than unlisted shares |

9 | 2,257 |

c. Information on the number of shares and balance sheet amount, etc., for each specified investment

Specified investment shares

For details about the specified investment shares, see the following PDF.