On becoming President

Fulfilling NeXuS II 2026 and solidifying the foundations for a 100-year company

On June 25, 2025, I became President & Representative Director of Kyoei Steel. Since joining the Company in 1999, I have been responsive for the whole-of-Japan area while working as a sales representative in the domestic steel business. Since 2020, I have served as Division Director of Yamaguchi Division, then as Board Director & Senior Vice President. When I joined the Company, it had an open culture that pursued factory floor-led manufacturing with a focus on the autonomy of each plant. There were challenges facing the Company, however, in terms of developing a sense of Group-wide unity and raising the floor on competitiveness and productivity with a view to future growth.

Former President Hirotomi dedicated his efforts not only to building the global tripolar structure centered on Japan, Vietnam and North America, but also to transforming the essence of the corporation in terms of its governance and compliance, building foundations for growth aimed at making Kyoei Steel a 100-year company. When I was sounded out about being appointed as President, I was told that the Company wanted me to “build the foundations for letting the next generation thrive, leveraging the insights built up to date on the ground.” I am a great believer in the “genba, genbutsu, genjitsu” principles of focusing on “real places, real products and concrete facts.” When I worked in sales, I would naturally visit the factory floor, and in my three years as Division Director of Yamaguchi Division, every day, without fail, I would, with my own eyes, see, sense and think through what was happening on the ground.I hope to pursue an approach to management that is informed by the insight I developed in those days and by a factory-floor perspective. I also value a culture of openness in which people can exchange views beyond the bounds of their status. I hope to develop the organization in a way that the Group as a whole can pull in the same direction to solve problems, by further fostering such an atmosphere.

I have developed a real sense that Kyoei Steel’s business is underpinned by our connections with various stakeholders, including customers, partner companies, equipment vendors, suppliers and transportation vendors. Gaining the trust of all our stakeholders is of the utmost importance, making it important that we proactively disclose information and avoid misleading statements.

Now, as unpredictable circumstances prevail in Japan and abroad, I will work to further shore up our connections with various stakeholders through faithful management. I also hope to achieve the targets set forth in our medium-term business plan, NeXuS II 2026, before going on to build the foundations for Kyoei Steel to be a 100-year company, while constantly keeping sight of changes in the market environment.

The external environment surrounding Kyoei Steel

Building a management structure leveraging various insights, amid dramatic change in the market

Electric furnace steelmakers, and especially steel rebar manufacturers, are facing a period of significant change. The domestic market demand for steel rebar has fallen to 6.2 million tonnes in FY2025, less than half of the 14 million tonnes it reached in FY1991. As demand contracts, however, the number of steel rebar manufacturers is flat, a state of affairs that one cannot avoid describing as oversupply on the level of the industry as a whole. Furthermore, as moves towards the realization of a decarbonized society gather pace, it is unavoidable that not only energy costs, but also manufacturing costs will rise, due to cost increases in secondary materials and alloys.

In contrast to the situation in Japan, however, in North America, where our Group has locations, the demand for construction steel and steel rebar is steady, and even in Vietnam, demand is recovering, so there is increasing potential to grow our results on the global market. While concerns have been raised recently over the impacts of tariff policies in the U.S., as part of our Group’s “GLOCAL (global and local) - Niche” Strategy, we have established a business model centered on local production for local consumption at our overseas locations. Therefore, even though there is still some potential for indirect impacts if there is a recession due to tariff policies, the direct impacts of tariffs themselves will be limited.

Amid this business environment defined by extreme upheaval, the Company is pursuing a management style of “leveraging the areas of strength of each leader to divide up roles.” We have taken the wheel of management by combining the management foundations provided by Chairman Takashima, the overall corporate planning perspective provided by Vice President Kan, the overseas strategy built and promoted by Executive Advisor Hirotomi, as well as the domestic steel business that I have been in charge of, and complementing each other’s strengths and weaknesses. The four of us will continue to express our respective strengths going forward, working with the over 3,900 employees across the Kyoei Steel Group as we seek to further increase the Company’s presence.

Looking back on the first year of NeXuS II 2026

Recognizing where we have adapted to change and where challenges remain amid a challenging market

FY2025 saw a challenging market environment with greater than expected impacts in Japan and abroad, resulting in increased revenues and decreased profits year over year. While we fell short of our initial target of 18 billion yen in consolidated operating income, thanks to the success of sales and cost measures, we achieved our revised target from October 2024 of 15 billion yen. Even under difficult conditions, our people on the ground worked hard and with determination, and I credit them with the results we achieved.

In our overseas steel business, Canadian sales of premium-priced fine rebar are growing steadily, with profits up year over year. In the U.S., we have dispatched engineers from Japan and held regular meetings with stakeholders to address production issues stemming from the deterioration of facilities. While the issues are on their way to being resolved, this process will take time. In Vietnam, we are continuing to struggle with intensifying competition. While we have reduced the scale of losses through cost reductions, overall, we accept that the situation remains challenging.

Growth strategies

Multidimensional growth strategy focused on the shrinking of the domestic market paving the way through Kanto, the environment and foreign markets

As mentioned above, demand for steel rebar in the domestic market continues to trend down. We believe that low-margin, high-volume ideas of “chasing volume by lowering prices” will not work to continue to secure profits even as the market itself contracts. Steel rebar, Kyoei Steel’s core product, is one where it is difficult for manufacturers to differentiate themselves. For that reason, how we can convey non-price value and how we can be the manufacturer of choice for customers are exceptionally important questions. I believe there are two keys to surviving in the domestic market.

The first is strengthening our presence in Kanto. While Kyoei Steel is Japan’s No. 1 electric furnace steelmakers by steel rebar market share, in the Kanto region, we have only developed a subset of our products. Going forward, we will aim to stabilize sales volumes and secure profits in the Kanto region, where a certain level of demand is forecast.

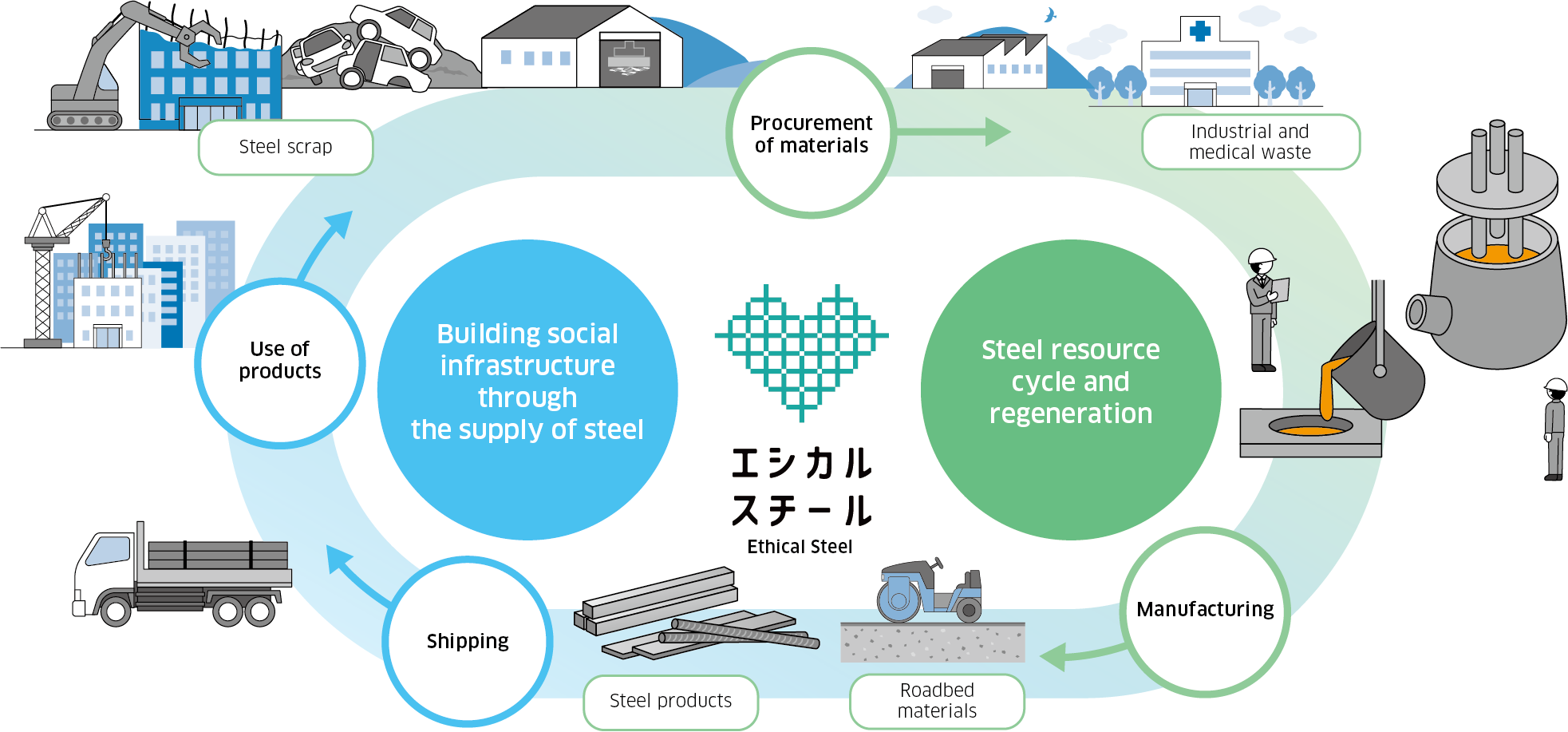

The second is strengthening the brand. Kyoei Steel boasts the technology to be able to process difficult-to-process waste products such as medical and industrial waste, all while minimizing the volume of CO2 emissions from the process. I am confident that the Ethical Steel concept, under which Kyoei Steel will be at the center of an entire supply chain, circulating resources, will be a tremendous advantage in becoming the manufacturer of choice in an era when addressing environmental issues is strongly demanded. The Company has also positioned the overseas steel business as a future driver of growth. We have already moved forward with large-scale facilities investments in various locations, and, in June 2025, we opened our new rolling line in Vietnam Italy Steel JSC’s factory in Hai Phong. While it is currently still ramping up to full production, we anticipate this will reduce costs and improve productivity going forward. We also invested some 38 billion yen from August 2025 in Vinton Steel LLC in the U.S., beginning work on installing a new electric arc furnace to replace the deprecated one and on upgrading the rolling mill. Work is due to be completed in early 2027.

While this falls outside the period of the NeXuS II 2026 plan, we hope to steadily complete this project and make it a long-term foundation for growth.

- 拡大

- Six key points of NeXuS II 2026

Investment in human capital

Promoting personnel development that is on-site first and aimed at the next generation, with “the power to connect” as key

Following on from NeXuS 2023, the previous medium-term business plan, we continue to make “connections” the theme of NeXuS II 2026 in the form of the power to connect among Group companies, the power to connect outside of Kyoei Steel, and the power to connect to the next generation. We are also approaching our human capital initiatives with these “three connections” in mind.

One measure we have taken under the rubric of “the power to connect among Group companies” has been an internal system called Omusubi (meaning “connection” in English). This is a system in which employees engage in practical work at a different location to usual for a set period, with the system targeting management departments in addition to manufacturing departments. The Company has four domestic locations, with each one having its own particularities in terms of management and operation methods. This initiative seeks to have people from each site learn from one another and spread the skills needed to prevent issues and accidents in advance.

For our sales departments, we are conducting training through “K-ma” (the Kyoei Marketing Academy) to have people learn about overseas manufacturing and distribution sites. Additionally, under our overseas training system, we provide young employees the opportunity to be dispatched overseas for several months and engage in practical work. We heard from employees who, in FY2025, took part in the launching of a new plant in Vietnam that they learned about how people worked locally, and that it proved to be a good experience. By having employees take on challenges locally, we aim to develop global personnel.

As part of the power to connect outside of Kyoei Steel, we are focusing on industry-academia connections, and have established a system for seconding employees to research laboratories at universities. In particular, our employees have researched topics such as how to make effective use of the slag produced as an impurity from the refining process or the technology for recovering zinc from dust in an effort to achieve zero emissions, as part of the pursuit of resource cycles for steel by-products.

As part of our efforts under the power to connect to the next generation, in FY2023, we established Human Resources Development Section, which conducts regular training targeting industrial technicians. The aim of the training is to have younger employees succeed the technique and knowledge of veteran and mid-level employees.

Brand strategy

Succession and inheritance, incorporating Ethical Steel and making environmentally friendly steelmaking the value customers choose us for

I believe that brand strategy and climate change measures are key to building the platform for our growth strategy.

The Company has pursued harmony between corporate growth and the global environment since the period of high economic growth, and has continued to practice environmentally conscious steelmaking. Symbolizing these efforts is our material recycling business. We established complete detoxification technology using scrap-melting heat 37 years ago, when medical waste products had become a challenge facing society, and developed this technology as a business. Similarly, using electric furnaces, we perform destructive processing of chlorofluorocarbons, with this also being a standout business of Kyoei Steel.

In FY2025, we rebranded the steel products manufactured while detoxifying medical waste as Ethical Steel. This is not to say that we developed a new product. Rather, this represented an effort to better convey as a brand the environmentally-conscious steelmaking that we had pursued for many years. Interest in the circular economy had increased compared to when the technology was first developed, and the path we had taken has begun to take on a more certain meaning. From FY2026, we further strengthened the Ethical Steel concept as an initiative across all four of our locations, expanding the concept to include industrial waste outside of medical waste.

To convey the value of Ethical Steel to the supply chain and to all our stakeholders, it is essential to start by having our employees themselves develop a deep understanding of their own efforts. In particular, the Company has worked earnestly to make steel in a way that is environmentally conscious since before the increased social interest in this. I believe it is important for employees to be reminded of this fact, and to share it widely within the Company. I also expect that if employees get a strong sense that their work has importance for society, this will help improve their pride in and engagement with their work.

In practice, when we present our Ethical Steel initiative to people outside the Company, we often find that the principle resonates with them. It is precisely for this reason that I hope to develop Ethical Steel as a brand through which we can share and co-create the principle of creating resource cycles throughout the entire supply chain with all people involved in building, including clients and builders, while personally acting as an advocate for the idea and promoting understanding of it internally. While the Company has always employed low-CO2-emission production methods using electric furnaces, we are constantly working to improve in this area in a way that is led by people on the ground, for example, further converting to low-carbon fuels and installing solar panels. As a specific example, we have completed work on facilities to convert the heating furnace at our Yamaguchi Division from oil to LNG. While the work will take multiple years, we are also progressing on fuel conversion work at our Kanto Division. Going forward, we will continue to advance decarbonization efforts to prepare ourselves for the risks and opportunities of the future.

To all our stakeholders

Overcoming uncertainty through management rooted in the factory floor

I believe that Kyoei Steel is in the midst of a critical phase, as we now seek to create foundations oriented towards sustainable future growth, with the aim of becoming a 100-year company. I have heard some investors raise concerns over whether we can really achieve stable growth going forward, particularly when it comes to our overseas steel business. This is why we are in an important stage of the business, where we are steadily advancing strategic investment aimed at improving our competitiveness, partly with the aim of building a stable earnings base. By properly shoring up our foundations over this medium-term business plan period, I intend to make our Company’s growth story even stronger, and to chart a steady course towards achieving our final target of ROE of over 8%.

Even amid a period of change, I believe the Company has many opportunities, and I am confident we are progressing towards our next stage. We will increase our capacities as a Group to a new level, based on relations of trust with people on the ground. This is why I hope that all our stakeholders will have even higher expectations with regard to the challenges and progress the Company will take on going forward. I sincerely hope to continue enjoying your support on this path.