The Group has made response to climate change one of its important management issues, and has taken a number of steps to advance them. We will continue to advance our initiatives for climate-change- related risks to and opportunities for our business in 2030 and 2050, in order to strengthen our resilience to the 1.5°C and below 2°C, and 4°C scenarios.

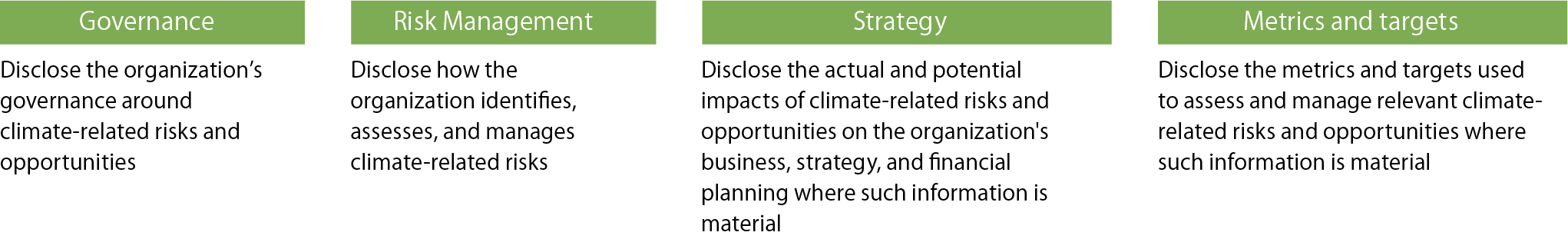

What is the TCFD?

TCFD stands for “Task Force on Climate-related Financial Disclosures.” It is a task force established by the Financial Stability Board (FSB) in which the central banks and financial regulators of major countries participate. To reduce the risk of instability in financial markets, the TCFD recommends that enterprises disclose information about the possible financial impact of climate-change-related risks to and opportunities for their businesses, alongside strategies and actions that will be taken to address them.

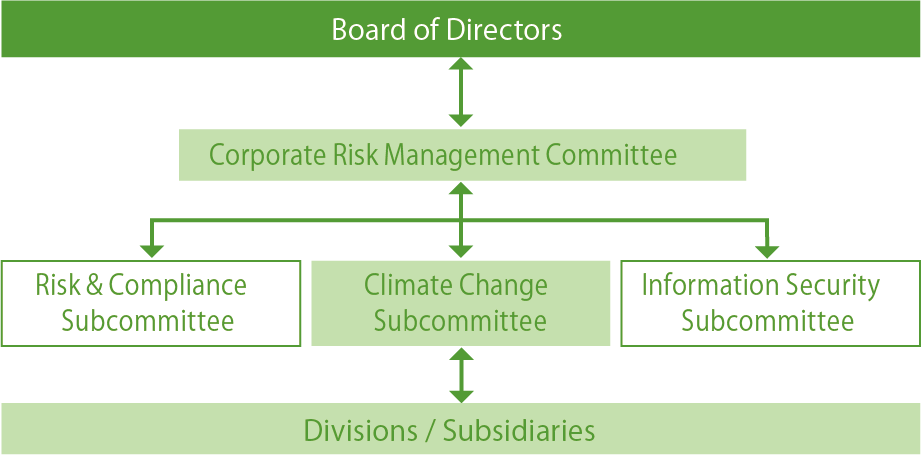

We have established a Corporate Risk Management Committee (CRMC), chaired by our president. We have also set up various subcommittees, including a Risk & Compliance Subcommittee and a Climate Change Subcommittee, which report to the CRMC.

We have created a system that allows us to assess and evaluate climate-change-related business risks at regular intervals. Risks and opportunities that are identified will be shared with the business operations divisions and/or subsidiaries concerned, so they can accelerate planning and implementation of countermeasures. The CRMC will report at regular intervals to the Board of Directors, which will supervise measures to be implemented.

The Group understands that climate change issues are important to its

business, and recognizes that the risks and opportunities associated with climate change must significantly influence its business strategies.

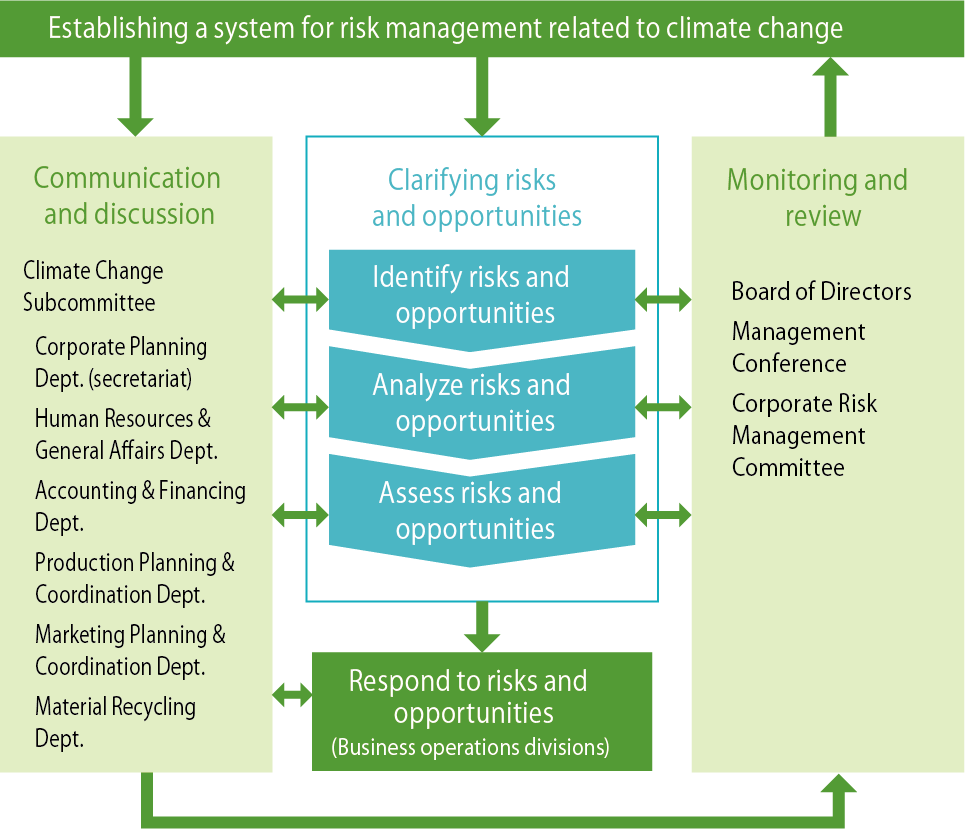

We have introduced the following processes into our organization to implement, support and maintain climate-related risk management as a matter of course.

❶ The Climate Change Subcommittee, whose secretariat is the ESG Promotion Section of the Corporate Planning Department, clarifies and assesses climate-change-related risks and opportunities for the entire Group.

❷ The Climate Change Subcommittee formulates policies and action plans pertaining to risk management related to climate change for the Group.

❸ Business operations divisions take appropriate actions, which may include risk avoidance, risk reduction or relocation, in accordance with the plans.

❹ The Climate Change Subcommittee reports the effects and results of riskmanagement to the CRMC at regular intervals.

Defining scenarios

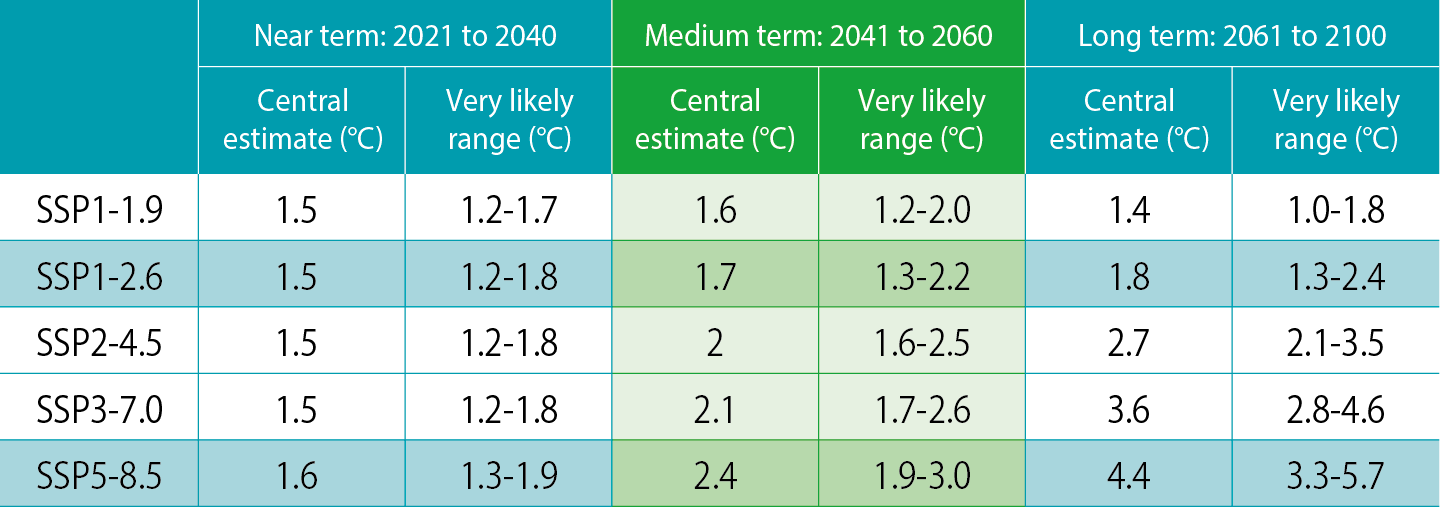

With reference to SSP1-1.9, SSP1-2.6 and SSP5-8.5—two of the five scenarios identified in the Sixth Assessment Report of the IPCC* corresponding to, respectively, 1.5°C and below 2°C, and 4°C increases in the average temperature of the Earth—we used the Six Forces Model to define changes in society surrounding the Group in 2050.

* IPCC: Intergovernmental Panel on Climate Change

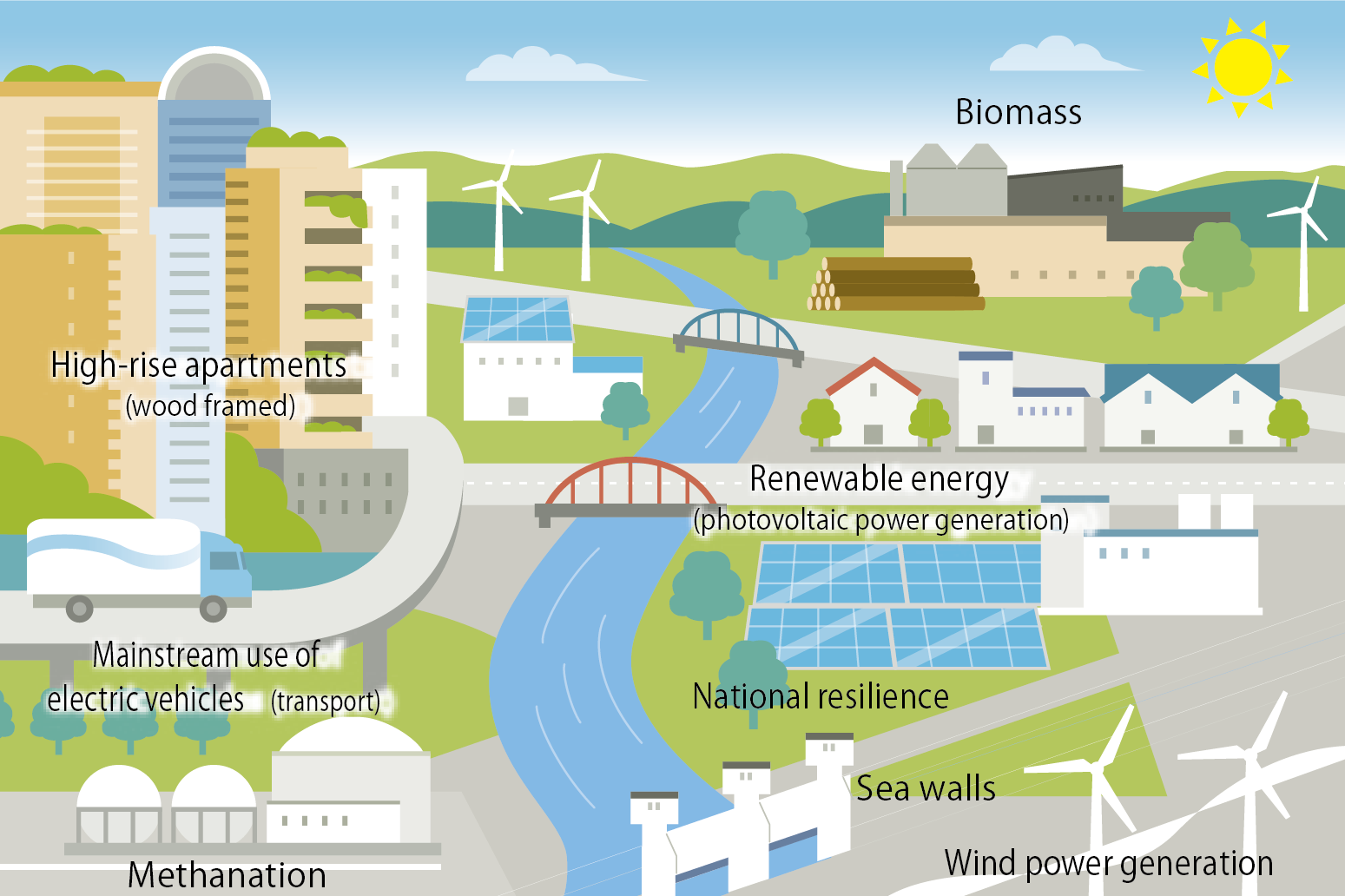

Changes in society surrounding the Group

[1.5°C and 2°C or lower scenario] Decarbonization progresses as demanded by society and by government regulations to mitigate climate change

● Government requests and regulations aiming to implement

decarbonization

• Fuel prices will rise due to the introduction of carbon pricing, e.g., carbon taxes.

• Electricity prices will rise temporarily due to an increase in the percentage of renewable energy, but will fall again by 2050.

● Intensifying stakeholder demand for decarbonization

• Decarbonization in cooperation with value chains will become important forbusinesses, and appropriate information disclosure and support will becomeimportant for trading.

• Adequate information disclosure and dialogue requested by shareholders and investors will become important.

● Mainstreaming of ESG evaluation by customers

• Countermeasures against climate change and other environmental issues will become mainstream and customers’ requests for disclosure and improvement of environmental performance data will intensify.

● Increase in natural disasters

• By 2050 the average temperature is approximately 1.2 to 2.0°C higher, so the number of natural disasters such as typhoons and floods will increase.

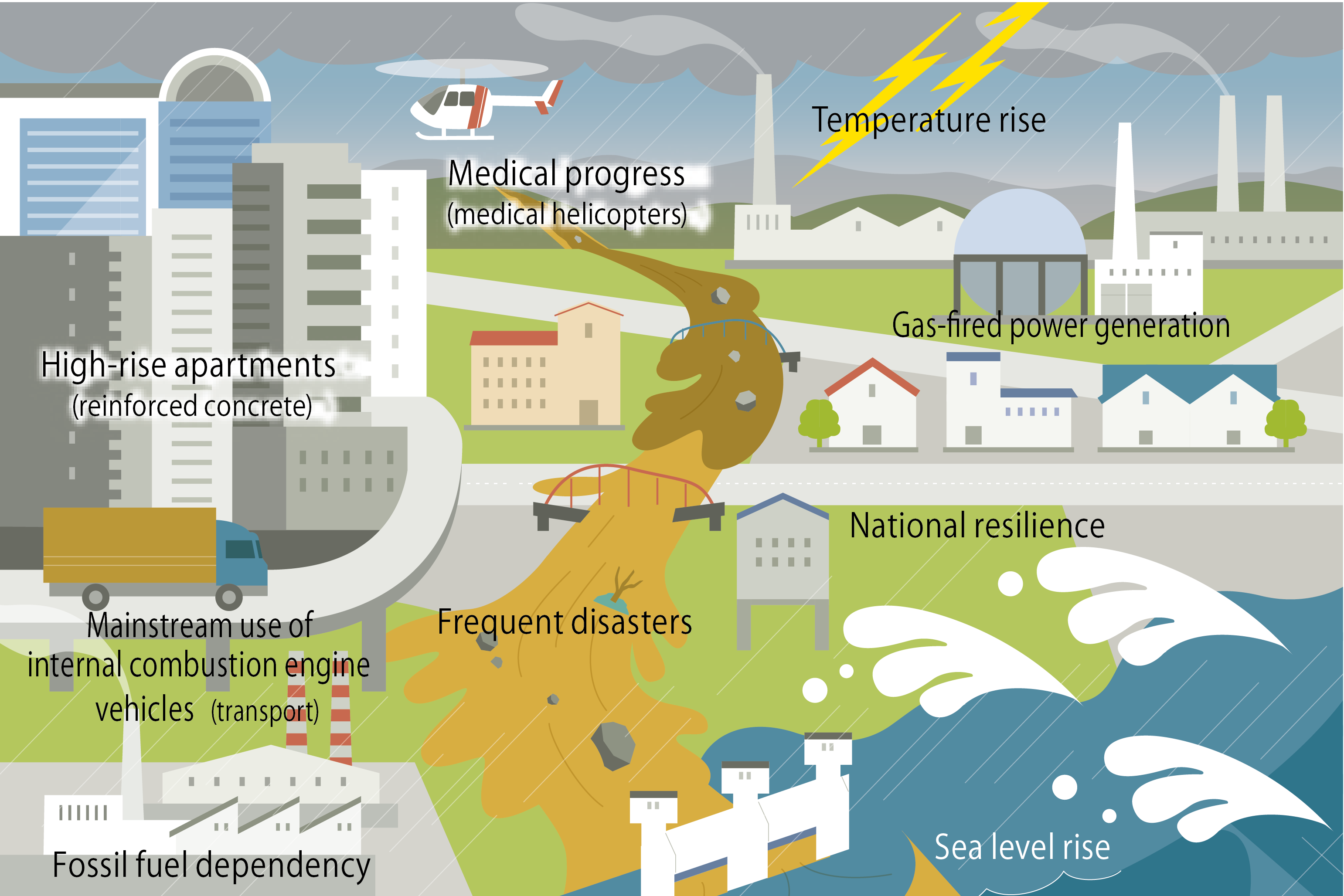

[4°C scenario] Adapt to productivity declines due to the impact of serious disasters and heat loads

● Limited government policies and regulations for decarbonization

• Mass consumption and fossil fuel dependency continue and fuel prices soar due to exhaustion of and competition for fossil fuels.

• Dependency on fossil fuel power generation increases electricity prices.

● Intensifying requests for business continuity management (BCM) by stakeholders

• BCM linked to value chains will become important for businesses, and adequate information disclosure and support will become important for trading.

● Products and services adapted to climate change

• It will become important for businesses to adapt products and services to changes to life circumstances and the work environment.

● Intensifying natural disasters

• By 2050, the average air temperature rises by approximately 1.9 to 3.0°C, and natural disasters such as typhoons and floods intensify.

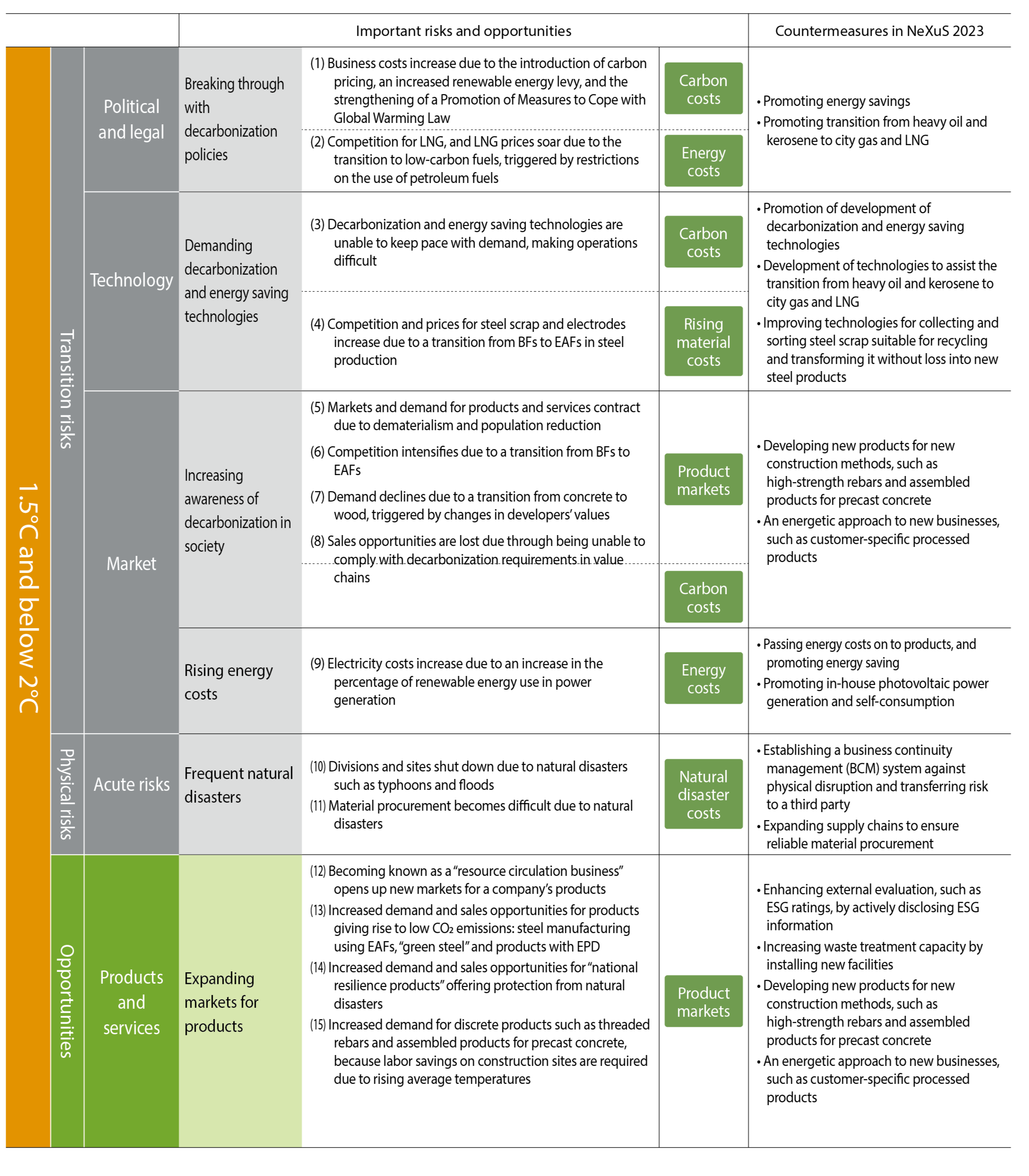

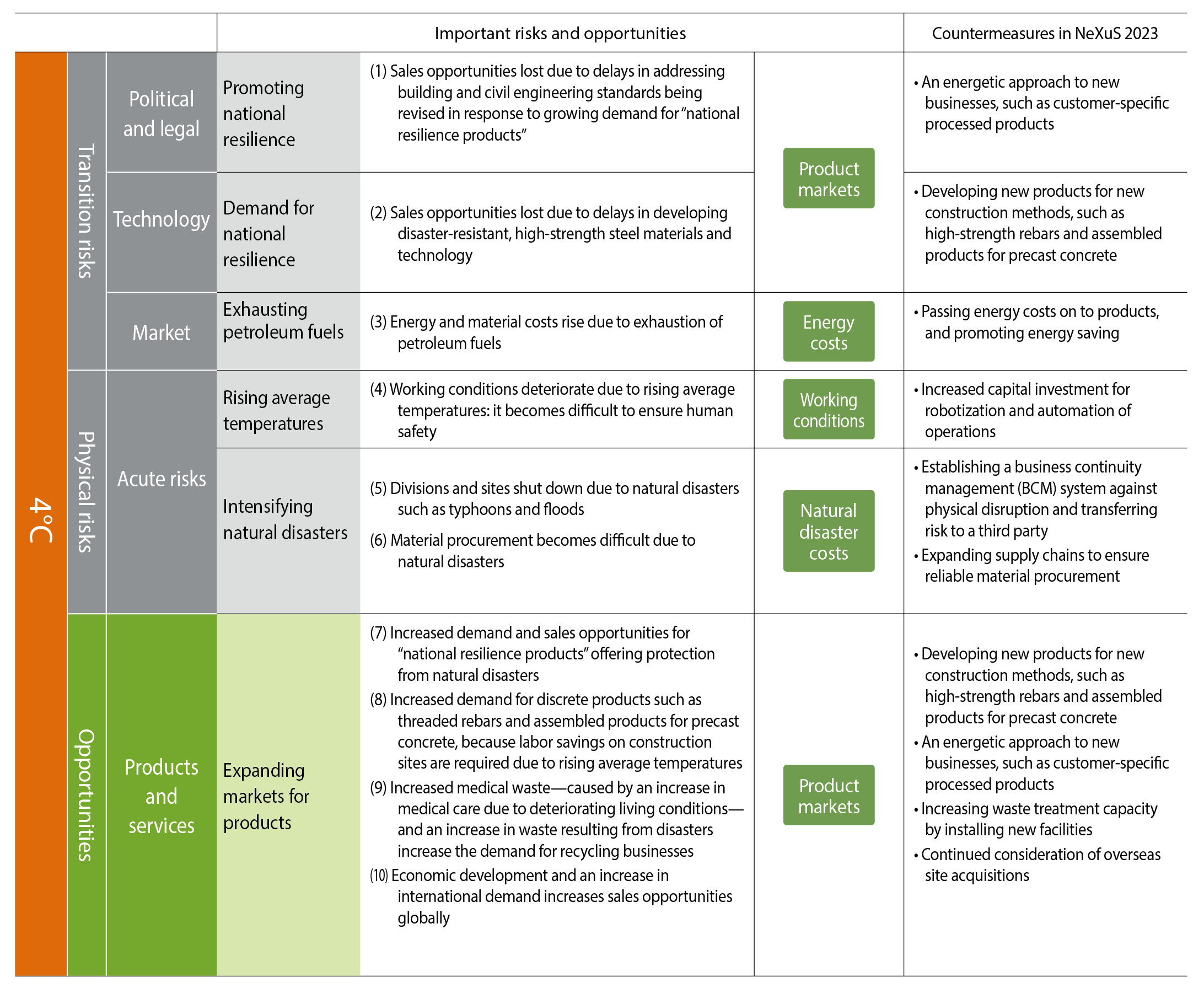

Scenario analysis

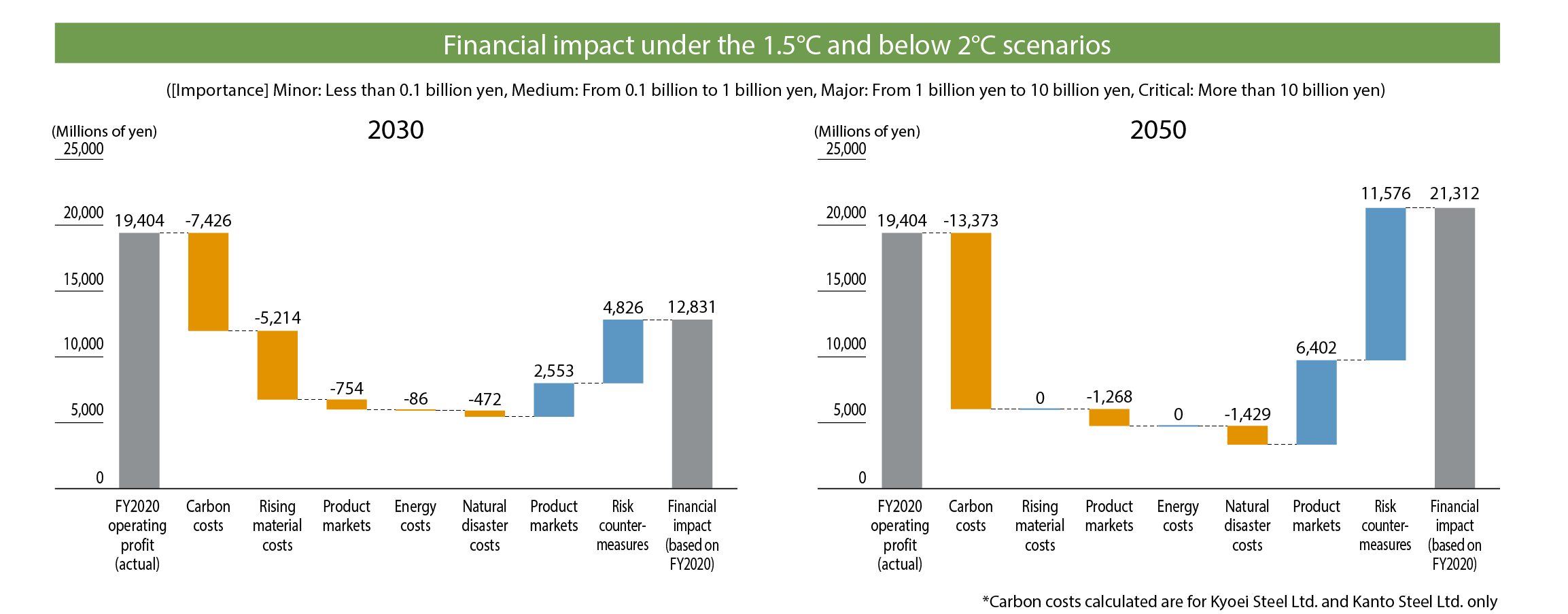

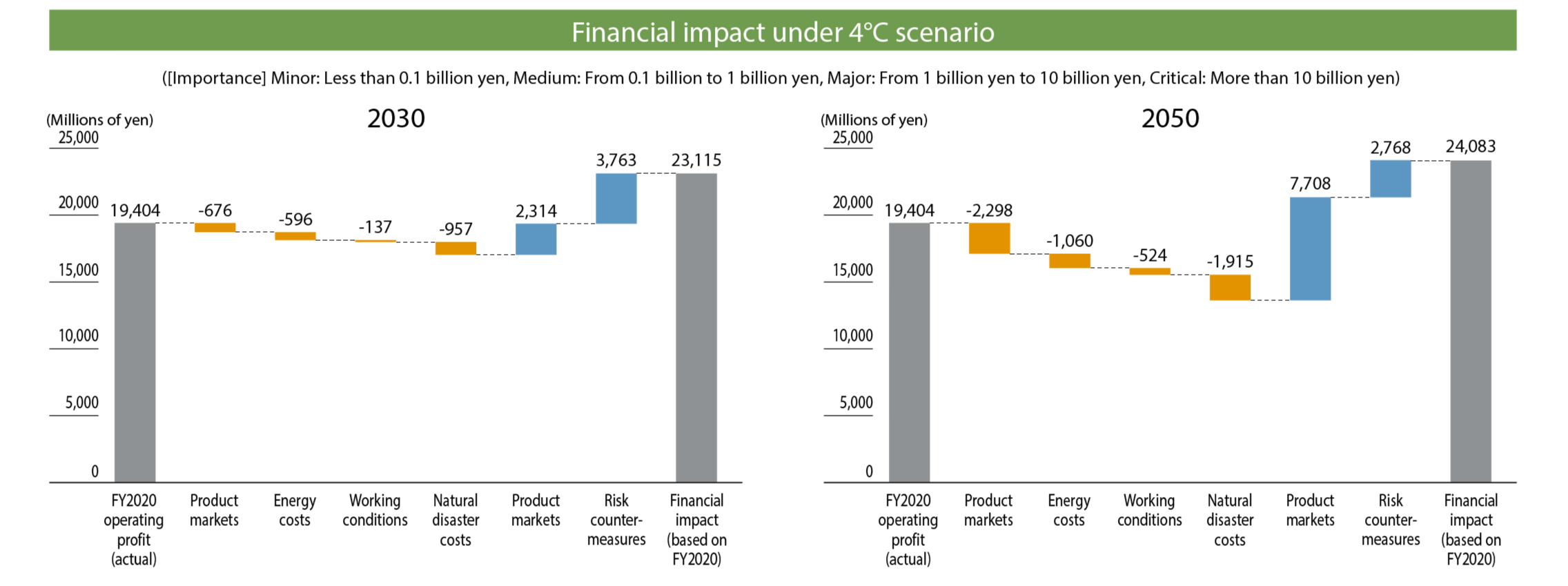

We evaluated the risks and opportunities for the Group under the 1.5°C and below 2°C, and 4°C scenarios according to their potential impact (major/medium/minor) on our Company in the near term (occurring within 3 years), medium term (within 3-10 years), and long term (10 years or more). We then organized the 15 risks and opportunities for the 1.5°C and below 2°C scenarios, and organized 10 risks and opportunities for the 4°C scenario into six categories: carbon costs, energy costs, rising material costs, product markets, natural disaster costs, and working conditions.

Financial impact

We estimated our financial impact based on parameters related to the six risks and opportunities we identified along with risk countermeasures.

We then quantitatively analyzed the importance of these parameters.

We believe it is important for the Group to determine how it is to reduce CO₂ emissions, especially in light of our measures against transition risks in the 1.5°C and below 2°C scenarios and mitigation of physical risks to society in the 4°C scenario. We have therefore established CO₂ emissions as our key measurement criterion, and have targeted a 50% reduction in emissions by FY2031 (compared with FY2014 [domestic production sites only]), based on the “CO₂ Emission Reduction Plan” to achieve net zero greenhouse gas emissions by 2050.